37+ mortgage interest standard deduction

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Answer Simple Questions About Your Life And We Do The Rest.

Mortgage Interest Deduction How It Works In 2022 Wsj

Web tax returns with itemized deductions Internal Revenue Service 2022.

. But for the 2018 tax year it is 24000 for a married couple filing jointly 18000 for a head of household and. Web You may need to amend if you filed and the mortgage interest deduction did not apply but would have had an effect on the outcome of your return. Web The deduction for mortgage interest is available to taxpayers who choose to itemize.

Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return. For 2022 the standard deduction is 25900 for married couples and 12950. Web Basic income information including amounts of your income.

Comparisons Trusted by 55000000. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan.

Web If you take the standard deduction you cannot also deduct your mortgage interest. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Homeowners who bought houses before.

Ad Looking For Conventional Home Loan. Homeowners who are married but filing. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. 5 Best Home Loan Lenders Compared Reviewed. Compare Lenders And Find Out Which One Suits You Best.

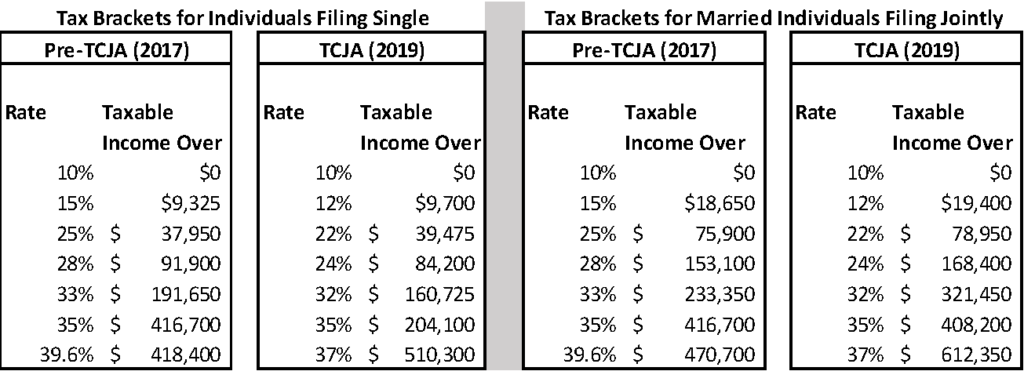

MIDs value to taxpayers depends on their marginal tax rate. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Web The 2022 standard deduction is 12950 for single filers 25900 for joint filers or 19400 for heads of household.

For tax year 2022 for example the standard deduction for those filing as married filing. Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. They also both get an additional standard deduction amount of.

Taxpayers in the 37 tax bracket for. Those numbers rise to 13850 27700 and 20800. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web For 2022 theyll get the regular standard deduction of 25900 for a married couple filing jointly. TT forcing me to. Web The standard deduction usually varies yearly.

Ad Shortening your term could save you money over the life of your loan. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Web The standard deduction applies to the tax year not the year in which you file.

G51671mmi009 Gif

What Expenses Can Be Deducted From Capital Gains Tax

Landlords Hands Tied Over Sme Tenants Boase Cohen Collins

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

Tax Benefits Of Owning A Home

What Are The Tax Benefits For Donations Quora

What Expenses Can Be Deducted From Capital Gains Tax

Free 37 Loan Agreement Forms In Pdf Ms Word

:max_bytes(150000):strip_icc()/TaxDeductibleInterest-10de394cbe27459ebb6f979a8f795083.jpeg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

What S Up West County March 2021 By What S Up Media Issuu

The New Year Is In Full Swing Know Your Limits And Get Ready To File Sensible Financial Planning

Mortgage Interest Deduction A Guide Rocket Mortgage

![]()

What Are The Tax Benefits For Donations Quora

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

If I Donate To A Charity Should I Really Put It On My Tax Form Quora

Free 50 Cash Flow Statement Format Samples In Google Docs Pdf Ms Word